Table of Contents

Introduction

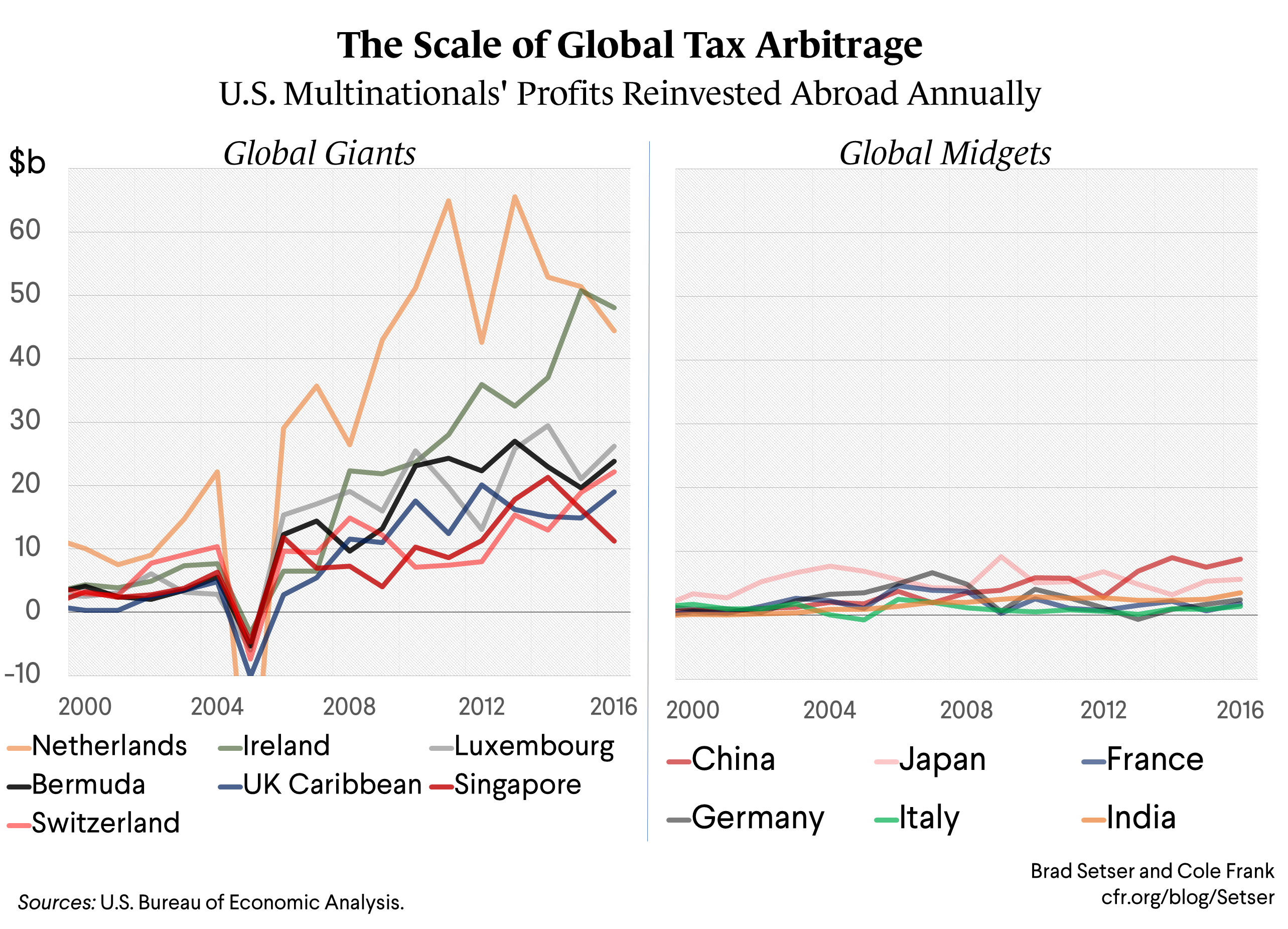

Tax arbitrage through cross-border financial engineering has become a pivotal strategy in the global financial landscape. This practice involves leveraging differences in tax regulations across jurisdictions to optimize financial outcomes for businesses and individuals. With the increasing globalization of markets, the ability to navigate and exploit these disparities has become a critical skill for financial professionals.

As multinational corporations expand their operations, understanding tax arbitrage becomes essential. The concept revolves around identifying opportunities to minimize tax liabilities by structuring financial transactions in a way that takes advantage of varying tax rates, incentives, and loopholes. This not only enhances profitability but also ensures compliance with international tax laws.

In this article, we will delve into the intricacies of tax arbitrage through cross-border financial engineering. We will explore the mechanisms, legal considerations, case studies, and future trends in this field. By the end, you will have a comprehensive understanding of how tax arbitrage works and its implications for businesses operating in a globalized economy.

Read also:Jung Somin A Comprehensive Guide To The Rising Kdrama Star

What is Tax Arbitrage?

Tax arbitrage is the practice of exploiting differences in tax laws between jurisdictions to achieve financial benefits. This can involve transferring income to low-tax jurisdictions, utilizing tax credits, or restructuring financial transactions to minimize tax liabilities. The primary goal is to reduce the overall tax burden while adhering to legal frameworks.

There are various forms of tax arbitrage, including:

- Transfer Pricing: Adjusting prices of goods and services between subsidiaries in different countries to allocate profits in low-tax regions.

- Tax Havens: Establishing entities in countries with favorable tax regimes to shelter income.

- Hybrid Instruments: Using financial instruments that are treated differently for tax purposes in different jurisdictions.

Understanding the nuances of tax arbitrage is crucial for businesses seeking to optimize their financial strategies. However, it is equally important to ensure that these practices align with ethical standards and regulatory requirements.

Understanding Cross-Border Financial Engineering

Cross-border financial engineering involves structuring financial transactions and instruments to achieve specific objectives, such as minimizing tax liabilities or maximizing returns. This practice often requires a deep understanding of international tax laws, financial markets, and regulatory frameworks.

Key components of cross-border financial engineering include:

- International Tax Treaties: Agreements between countries that govern how income is taxed across borders.

- Double Taxation Avoidance: Mechanisms to prevent the same income from being taxed twice in different jurisdictions.

- Financial Instruments: Tools such as derivatives, bonds, and equity that can be tailored to exploit tax differences.

Role of Financial Instruments

Financial instruments play a critical role in cross-border financial engineering. For instance, companies may issue hybrid securities that qualify as debt in one jurisdiction and equity in another. This dual classification can lead to significant tax advantages, such as interest deductions in one country and dividend exemptions in another.

Read also:1975 Year Of The Chinese Zodiac Unveiling The Mystical Rooster

Mechanisms of Tax Arbitrage

Tax arbitrage operates through various mechanisms that exploit differences in tax systems. Below are some of the most common strategies used by businesses and individuals:

1. Transfer Pricing

Transfer pricing is a widely used mechanism in tax arbitrage. It involves setting prices for transactions between related entities in different jurisdictions. By strategically pricing goods, services, or intellectual property, companies can allocate profits to low-tax regions.

2. Thin Capitalization

Thin capitalization refers to the practice of funding a subsidiary with a high proportion of debt relative to equity. This allows the subsidiary to deduct interest payments, which are often taxed at a lower rate than profits.

3. Offshore Entities

Establishing offshore entities in tax havens is another common mechanism. These entities can hold assets, manage intellectual property, or act as intermediaries in financial transactions, thereby reducing the overall tax burden.

4. Hybrid Mismatch Arrangements

Hybrid mismatch arrangements exploit differences in how financial instruments are classified across jurisdictions. For example, a payment may be treated as interest in one country (tax-deductible) and as a dividend in another (tax-exempt).

Legal and Ethical Considerations

While tax arbitrage can offer significant financial benefits, it is essential to consider the legal and ethical implications. Tax authorities worldwide are increasingly scrutinizing cross-border financial engineering practices to prevent abuse and ensure fairness.

Regulatory Compliance

Businesses must ensure that their tax strategies comply with international tax laws and treaties. Non-compliance can result in penalties, reputational damage, and legal consequences. For instance, the OECD's Base Erosion and Profit Shifting (BEPS) initiative aims to combat tax avoidance by multinational corporations.

Ethical Responsibility

Beyond legal compliance, businesses have an ethical responsibility to contribute to the societies in which they operate. Aggressive tax avoidance practices can undermine public trust and lead to negative perceptions of corporate behavior.

Case Studies

Examining real-world examples provides valuable insights into the application of tax arbitrage through cross-border financial engineering. Below are two notable case studies:

Case Study 1: Apple's Tax Strategy

Apple Inc. has been a prominent example of tax arbitrage. The company utilized Irish subsidiaries and transfer pricing strategies to allocate significant profits to low-tax jurisdictions. This approach allowed Apple to minimize its global tax liability, sparking debates about corporate tax fairness.

Case Study 2: Starbucks and Transfer Pricing

Starbucks faced scrutiny for its transfer pricing practices in Europe. The company was accused of shifting profits to low-tax countries, resulting in minimal tax payments in higher-tax jurisdictions. This case highlighted the challenges of enforcing international tax regulations.

Risks and Challenges

While tax arbitrage offers financial benefits, it also comes with significant risks and challenges. Understanding these factors is crucial for businesses considering cross-border financial engineering strategies.

1. Regulatory Scrutiny

Tax authorities are increasingly focused on combating aggressive tax avoidance. Initiatives like BEPS and country-by-country reporting requirements have made it more challenging for businesses to exploit tax disparities.

2. Reputational Risk

Public perception of tax avoidance can damage a company's reputation. Consumers and stakeholders may view aggressive tax strategies as unethical, leading to boycotts or loss of trust.

3. Complexity and Cost

Implementing cross-border financial engineering strategies can be complex and costly. Businesses must invest in expert advice, compliance systems, and ongoing monitoring to ensure adherence to regulations.

Regulatory Frameworks

Several regulatory frameworks govern cross-border financial engineering and tax arbitrage. These frameworks aim to ensure transparency, fairness, and compliance with international tax laws.

OECD's BEPS Initiative

The OECD's Base Erosion and Profit Shifting (BEPS) initiative addresses tax avoidance strategies that exploit gaps in international tax rules. It includes measures such as country-by-country reporting and anti-abuse provisions.

European Union Directives

The EU has implemented directives to combat tax avoidance, such as the Anti-Tax Avoidance Directive (ATAD). These measures include rules on controlled foreign companies, interest limitations, and hybrid mismatches.

Country-Specific Regulations

Individual countries have also introduced regulations to address cross-border tax issues. For example, the United States enforces the Foreign Account Tax Compliance Act (FATCA) to ensure transparency in offshore financial activities.

Future Trends in Tax Arbitrage

The landscape of tax arbitrage is continually evolving. Emerging trends and developments are shaping the future of cross-border financial engineering:

1. Digitalization of Tax Systems

Governments are increasingly adopting digital tools to enhance tax compliance and transparency. Technologies such as blockchain and artificial intelligence are being used to monitor cross-border transactions and detect tax avoidance.

2. Global Minimum Tax

The introduction of a global minimum tax rate, as proposed by the OECD, aims to reduce profit shifting to low-tax jurisdictions. This initiative seeks to create a more level playing field for businesses worldwide.

3. Sustainable Tax Practices

There is growing emphasis on aligning tax strategies with sustainability goals. Businesses are encouraged to adopt responsible tax practices that contribute to societal well-being and environmental sustainability.

Conclusion

Tax arbitrage through cross-border financial engineering is a complex yet powerful strategy for optimizing financial outcomes. By leveraging differences in tax regulations, businesses can achieve significant tax savings while navigating a challenging regulatory landscape.

However, it is crucial to balance financial benefits with legal compliance and ethical responsibility. As regulatory frameworks evolve, businesses must stay informed and adapt their strategies to remain compliant and competitive.

We encourage you to share your thoughts on this topic in the comments below. If you found this article helpful, please consider sharing it with others or exploring more content on our site to deepen your understanding of global financial practices.